Energy & Infrastructure

ENERGY

The firm’s energy team has maintained its enviable position at the cutting edge of transactions at the center of the power sector transformation in Nigeria.

The team gained its initial energy experience when it advised the defunct National Electric Power Authority (“NEPA”) in connection with re-negotiating its power purchase agreement with Enron. The team went on subsequently to represent the regulator in its negotiations with prospective independent power producers. The team worked with NEPA for four years and in the course of that time, advised in connection with a power purchase agreement with Agip and Shell. This experience provided us with a unique opportunity to acquire theoretical as well as practical knowledge of the industry and to develop strong contacts at various levels of the industry.

The team has been very active in advising on various aspects of the overhaul and privatisation of the Nigerian power sector. It regularly advises various clients on matters such as the regulatory framework for development, design, financing, ownership and construction of power projects in Nigeria; the processes and procedures for obtaining authorisations from the Nigerian Electricity Regulatory Commission; joint ventures; investments; technical service and management relationships with local companies; the viability of certain proposed power financing arrangements under Nigerian law, and on negotiating and drafting industry contracts like Power purchase agreements, Engineering, Procurement and Construction contracts, Long Term Service Agreements and Operation and Maintenance Contracts. The team also provides advice and dispute resolution representation and support to multinational and indigenous companies in connection with their day-to-day operations, projects and transactions.

More recently, the team represented a consortium of local and international lenders including international financial institutions in relation to the financing of an integrated power project that is being developed by a local operator. The team represents lenders in transactions relating to the proposed financing of a gas-fired power plant; being the first phase of a project that will result in an eventual capacity of over 550 MW. The team has also advised an international oil company that proposes to develop a power station of over 400 MW, and is advising a joint venture between a global and a local power company in connection with the design, development, financing and construction of a 500 MW power station.

The team routinely advises local and multinational pioneers and would-be participants in connection with their various investments in the power sector, including generation and distribution and with various gas and pipeline projects that connect gas to power stations. It also advises corporates offering captive power generation and other power project services and their offshore principals in connection with their projects in Nigeria. In addition to its transactional experience, the team has also provided support to the National Electricity Regulatory Commission in the drafting of its regulations.

INFRASTRUCTURE AND PROJECTS

Our project finance experience covers the broad spectrum of structuring, documenting and negotiating in relation to national, international and multi-national projects. The team offers the experience and capability that has evolved from regularly working on some of the most important, innovative and complex projects in Nigeria. Its solution-orientated approach focuses on delivering practical solutions. We have advised and continue to provide advice to clients with respect to the financing of projects in diverse sectors such as:

- Infrastructure (including gas pipelines);

- Transportation (including airports, roads and railways);

- Power and energy (including power generation and distribution);

- Manufacturing (including cement production), oil and gas (including pipelines); and

- Telecommunications (including towers); and public private partnerships (PPPs including tolls roads etc).

We understand the underlying business issues and risks and work constructively with project parties to allocate risks efficiently. With the skills and substantial experience of our project development and finance group, clients have come to rely on us to provide the in-depth industry knowledge, local market expertise, practical solutions and clear strategies to make a deal ‘bankable’.

The firm has often been required to advise on structures and devices such as limited recourse project financings, off-shore escrow accounts, dedicated accounts and dedicated revenue streams from product sales, and on the effect of the negative pledge and other restrictive covenants that arise from existing Nigerian sovereign obligations. Recent assignments have included advising a wholly-owned subsidiary of an international oil and gas company in connection with a foreign currency-denominated facility for refinancing existing debt constructing a gas processing facility and development and construction of various pipeline projects in Nigeria.

The team has earned its reputation for providing expert advice to local and international banks and project developers in relation to credit enhancements like the World Bank Partial Risk Guarantee programme for gas and power in Nigeria, various equity instruments to assist with equity contribution of the sponsors, the provision of acquisition finance facilities to local, regional and international finance institutions in relation to the financing of projects in various sectors including the power sector in Nigeria.

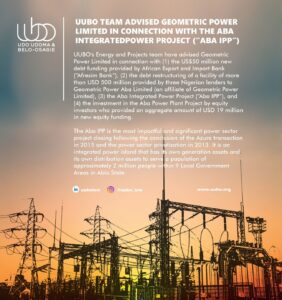

Deals

Recognition

No posts found!

- Project negotiations

- Public procurement

- PPPs and PFIs

- PPAs

- Licensing

- Land acquisitions

- Exploration contracts

- EPC

- Concession agreements

- Climate Change

- Energy and Natural Resources Arbitration

- Oil and Gas

- Power

- Hydrogen Energy